Renters Insurance in and around Chambersburg

Your renters insurance search is over, Chambersburg

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

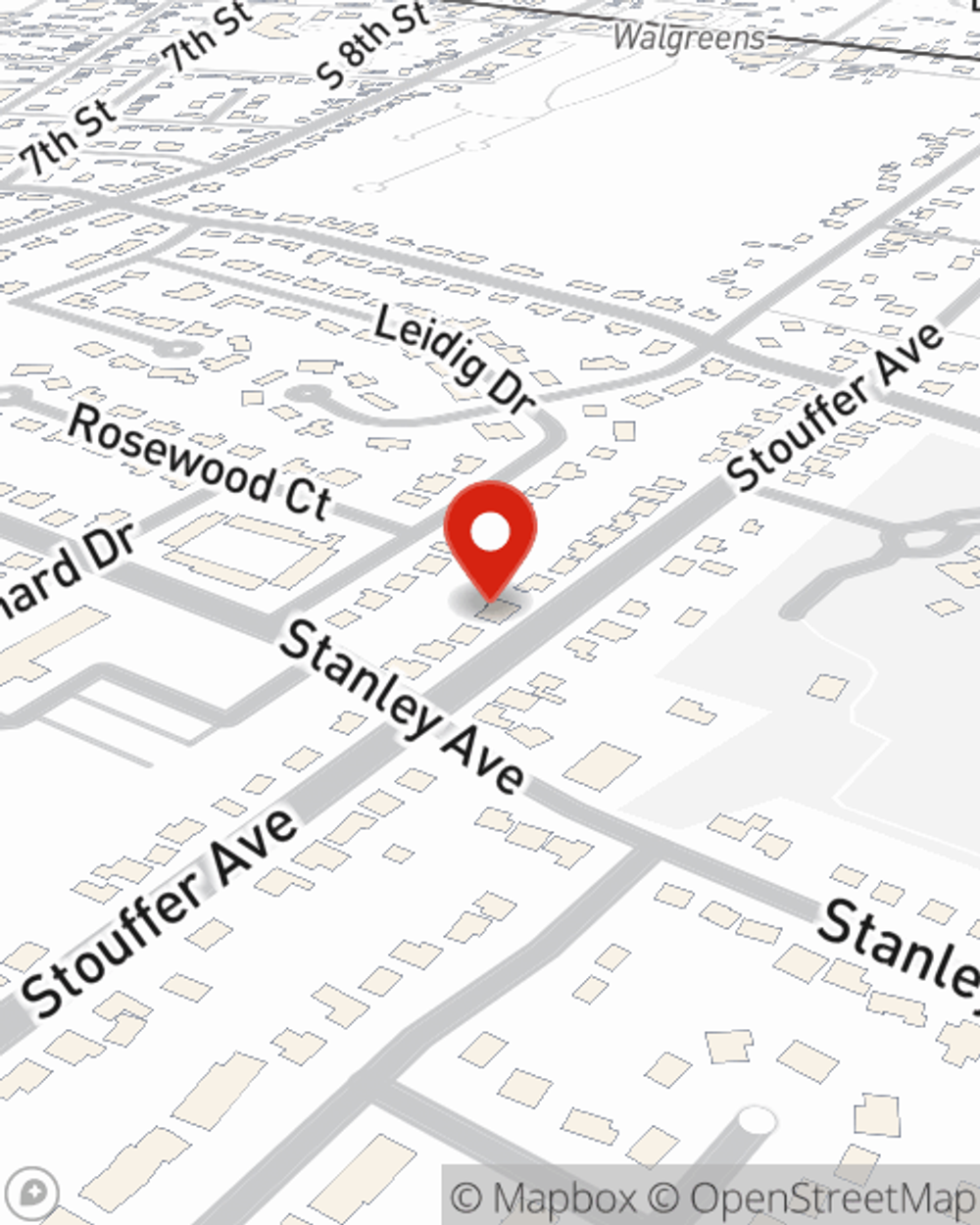

You have plenty of options when it comes to choosing a renters insurance provider in Chambersburg. Sorting through coverage options and savings options to pick the right one is a lot to deal with. But if you want cost-effective renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy remarkable value and hassle-free service by working with State Farm Agent Kim Stouffer. That’s because Kim Stouffer can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including jewelry, clothing, pictures, furnishings, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Kim Stouffer can be there to help whenever the unexpected happens, to get your homelife back to normal. State Farm provides you with insurance protection and is here to help!

Your renters insurance search is over, Chambersburg

Coverage for what's yours, in your rented home

State Farm Has Options For Your Renters Insurance Needs

Renters insurance may seem like last on your list of priorities, and you're wondering if having it is actually beneficial. But imagine the cost of replacing all the belongings in your rented property. State Farm's Renters insurance can help when unexpected mishaps damage your belongings.

As a dependable provider of renters insurance in Chambersburg, PA, State Farm is committed to keeping your belongings protected. Call State Farm agent Kim Stouffer today and see how you can save.

Have More Questions About Renters Insurance?

Call Kim at (717) 267-0406 or visit our FAQ page.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Kim Stouffer

State Farm® Insurance AgentSimple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.